Reclaiming Our Future: Why Singaporeans Should Take Back Control of Temasek Holdings, 【重夺我们的未来:为什么新加坡人应当重新掌握淡马锡控股的主导权】

Reclaiming Our Future: Why Singaporeans Should Take Back Control of Temasek Holdings 🌏

重夺我们的未来:为什么新加坡人应当重新掌握淡马锡控股的主导权 🌏

When we speak of Singapore’s economic success, few institutions symbolize it as much as Temasek Holdings. Established in 1974, Temasek was meant to manage Singapore’s strategic assets, growing from its humble beginnings into a global investment powerhouse with an estimated S$400 billion portfolio.

谈及新加坡的经济成就,淡马锡控股(Temasek Holdings) 无疑是最具代表性的机构之一。自1974年成立以来,淡马锡肩负着管理新加坡战略性资产的重任,资产组合规模已扩展至约 4000亿新元,遍及全球。

Yet, one uncomfortable truth remains: Despite being funded through the collective effort of Singaporeans — the taxpayers, the workforce, the nation-builders — the people of Singapore have little say over Temasek’s operations, investment decisions, or the returns generated from their own national assets.

然而,一个不容忽视的现实是: 尽管淡马锡的资本来自新加坡人民——纳税人、劳动者、国家建设者的共同努力,但新加坡人民对其运营决策、投资方向以及资产回报几乎没有任何发言权。

In an era where global conversations on wealth distribution, transparency, and governance are intensifying, isn’t it time for Singaporeans to take back control of their sovereign wealth?

在全球日益重视财富分配、透明治理的当下,新加坡人是否该思考:是时候重新掌握属于我们的国家财富了吗?

Beyond Ownership: The Need for Participation, Accountability, and Fair Distribution 🙋♂️

不仅是名义上的所有权:人民参与、问责制与公平分配的必要性 🙋♂️

Temasek operates like a private investment firm, reporting directly to the Ministry of Finance. But there is no citizen representation, no voting rights, and no mandatory alignment with Singaporeans’ collective interests on crucial decisions such as:

- Which industries are funded?

- Whether investments support or undermine Singapore’s sustainability ambitions?

- Whether the people, whose collective labor and trust built these reserves, should receive direct benefit or equitable returns?

淡马锡的运作方式更接近一家私人投资公司,直接向财政部汇报。然而,人民在这一治理结构中没有代表席位、没有投票权,国家的投资方向是否真正符合全民利益,缺乏必要的透明与参与机制:

- 资金投向了哪些行业?

- 这些投资是否符合新加坡的可持续发展目标?

- 这些国家资产的回报,是否有合理、公平地惠及每一位新加坡人?

In contrast, other sovereign wealth models around the world — such as Norway’s Government Pension Fund and Alaska’s Permanent Fund Dividend — showcase pathways where citizens are not just passive observers but rightful participants and beneficiaries.

与之相比,世界上其他国家的主权财富基金,如挪威政府养老基金及阿拉斯加永久基金红利计划,已实践了让人民不仅是被动的旁观者,更是应有的参与者和受益人。

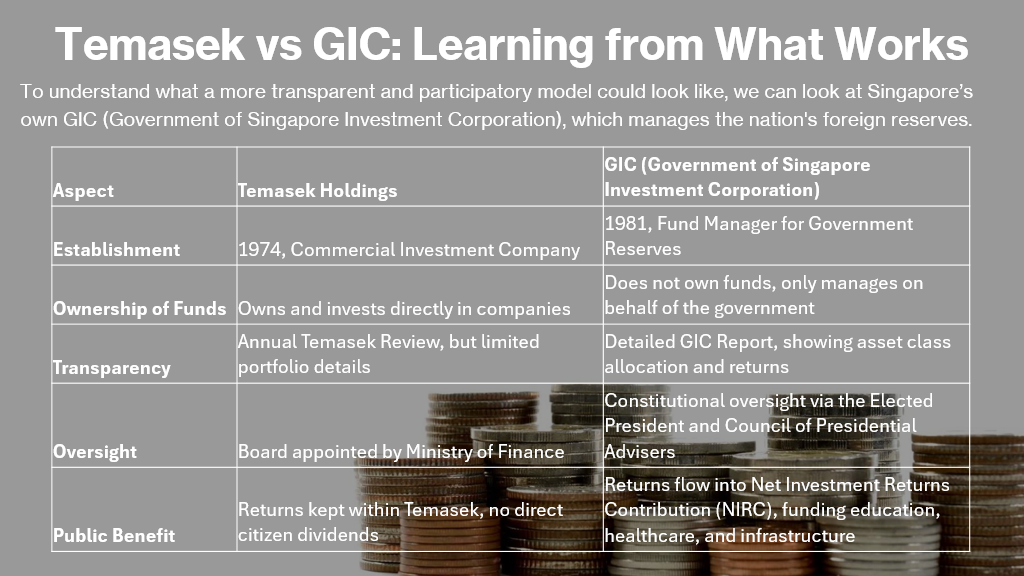

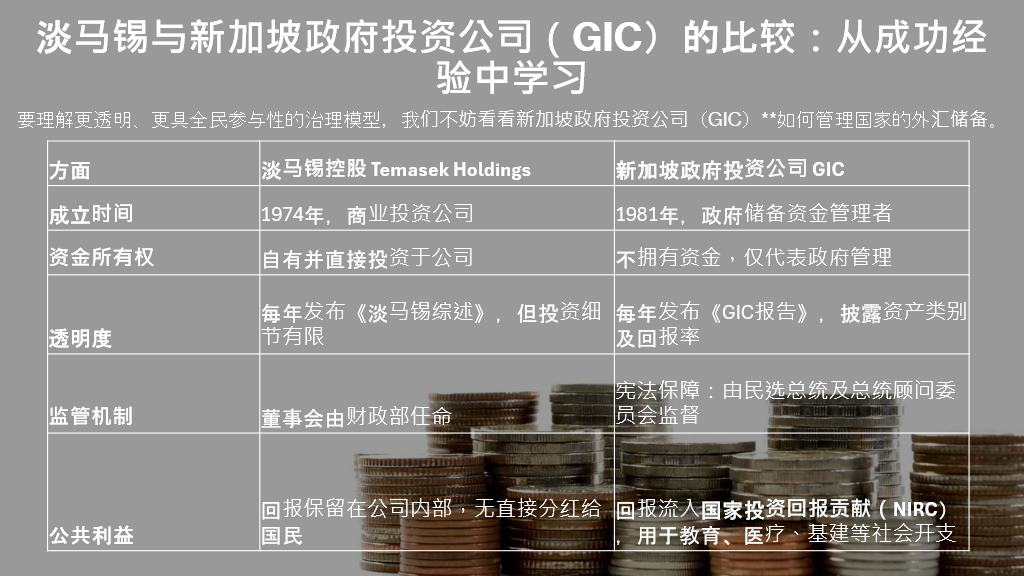

Temasek vs GIC: Learning from What Works 👔

To understand what a more transparent and participatory model could look like, we can look at Singapore’s own GIC (Government of Singapore Investment Corporation), which manages the nation’s foreign reserves.

The key differentiator? GIC’s constitutional safeguards and its role in supporting Singapore’s budget directly, benefiting all Singaporeans.

淡马锡与新加坡政府投资公司(GIC)的比较:从成功经验中学习 👔

要理解更透明、更具全民参与性的治理模型,我们不妨看看 新加坡政府投资公司(GIC)如何管理国家的外汇储备。

The Illusion of Independence: When Power Hides Behind Layers of Institutions 🍃

独立性的假象:当权力隐藏在层层机构和框架之后 🍃

One of the most common mechanisms by which concentrated power sustains itself is through the careful construction of layers of institutional separation. On the surface, many governance structures appear independent — with boards, committees, and regulatory frameworks designed to signal neutrality and accountability. Yet, history has shown that true influence often operates behind these façades, where key appointments, funding decisions, and strategic directions remain tightly controlled by a small, interconnected network of individuals.

权力为了自我延续,往往会通过精心设计的多层机构分隔来隐藏其真正的影响力。表面上,许多治理结构看似独立,设有董事会、委员会和各种监管框架,以展示中立和问责。然而,历史屡次证明,真正的决策权常常隐藏在这层“独立”面纱背后,关键的人事任命、资金流向与战略方向,实则被少数紧密相连的个人或家族牢牢掌控。

Such layering creates what some scholars call “plausible deniability” — the ability to deflect scrutiny by pointing to formal structures that suggest impartiality, while in practice, decisions flow through channels shaped by unseen hands. These networks may not always be formalized in writing, but they manifest through longstanding relationships, reciprocal favors, and gatekeeping of key leadership positions.

这种层层叠加的安排,学者们称之为**“合理否认”(plausible deniability)——即通过表面的制度设计规避质疑,掩盖真正的利益链条。虽然这种权力网络未必在书面上明确存在,但却通过长年累月的关系纽带、互惠互利的安排,以及对关键岗位的把控**悄然发挥作用。

When governance operates this way, the public may mistakenly believe that checks and balances exist, even as meaningful oversight is systematically neutralized. This is why genuine transparency is not just about published reports or organizational charts — it is about ensuring that decision-making processes are open to scrutiny, that leadership pathways are not monopolized, and that power is not hidden beneath layers of manufactured independence.

当治理架构被这样运作时,公众往往误以为有健全的制衡机制,殊不知实质性的监督已被有意无意地架空。这也正是为什么我们强调,真正的透明不仅仅是发布报告或展示组织结构图那么简单,而是要确保决策过程公开透明,领导职位不被垄断,权力不再藏匿于表面的“独立”假象之下。

A Call to Reform: Why Public Ownership Must Mean Public Participation 📜

改革的呼声:公有就必须有公民参与 📜

True ownership is not about symbolism — it is about having a voice, representation, and equitable benefit.

所谓的“公有”,不能只是口号,而应体现在人民的实际参与、话语权与公平受益。

Imagine a Temasek where:

- Singaporeans elect or nominate independent citizen representatives to its board.

- Investment directions undergo public review for alignment with national values, including ESG priorities.

- Returns beyond what is needed for reinvestment are shared with Singaporeans, whether through social dividends, education credits, or healthcare subsidies.

设想这样一个淡马锡:

- 由新加坡人民选举或提名的独立公民代表参与董事会决策;

- 投资方向经过公众审议,确保符合国家价值观与环保、社会责任(ESG)目标;

- 超出再投资需求的回报部分,合理分享给新加坡人民,用于社会红利、教育补助或医疗补贴。

Global Lessons, Local Action ✅

全球经验,本地行动 ✅

Other nations are watching. The world increasingly recognizes that sovereign wealth belongs to the people. Whether it is Norway’s citizen-centered model or Alaska’s dividend scheme, these examples show that shared prosperity strengthens national unity and economic resilience.

全球正在关注:主权财富理应属于人民。挪威、阿拉斯加等地的实践表明,共享繁荣不仅能增强国家凝聚力,也能提升经济韧性。

Singapore, known for its excellence in governance, can lead this next evolution — by ensuring that Temasek serves not just as a financial institution, but as a true steward of the people’s wealth.

新加坡以良好的治理闻名全球,如今正是引领主权财富治理升级的最佳时机。让淡马锡不仅是金融机构,更是人民财富的真正守护者。

Conclusion: A Future Worth Building Together 🤲

结语:共同打造值得托付的未来 🤲

Reclaiming influence over Temasek is not about dismantling what works. It is about updating the governance architecture to match the maturity of our society.

重夺淡马锡的全民参与权,不是要破坏已有的成就,而是要提升治理架构,使之与我们社会的成熟度相匹配。

It is about telling every Singaporean — from hawkers to PMETs, from students to retirees — You have a stake. You have a say. You will share in the returns of the wealth you helped build.

这是一句对每一位新加坡人的承诺——无论是小贩、专业人士,还是学生与退休者: 这是属于你的财富,你有发言权,你应当分享你曾一同创造的成果。

What are your thoughts? Should Singaporeans have a greater say over Temasek Holdings? How can we ensure our reserves work for all of us, not just a select few?

你的看法如何?新加坡人是否应当在淡马锡的治理中拥有更多的参与权?我们又该如何确保国家储备真正服务于全民,而非少数人?

Join the conversation. Your voice matters. #Singapore #Governance #Temasek #GIC #SovereignWealth #Transparency #Accountability #SharedProsperity #NationBuilding #FutureOfSingapore

📚 Further Reading | 延伸阅读

To deepen your understanding of global best practices in sovereign wealth governance and citizen participation, here are examples from Norway and Alaska that may inspire Singapore’s next steps:

为了更好地理解全球主权财富治理与公民参与的最佳实践,以下是挪威和阿拉斯加的成功案例,或可为新加坡未来的发展提供启发:

Norway Government Pension Fund Global (GPFG) 挪威政府养老基金全球 (GPFG)

- Managed by Norges Bank Investment Management on behalf of the Ministry of Finance. 由挪威银行投资管理局代表财政部负责管理。

- World’s largest sovereign wealth fund (US$1.6 trillion+ as of 2024). 截至2024年,全球规模最大的主权财富基金(超1.6万亿美元)。

- Built from oil revenues to ensure intergenerational wealth sharing. 利用石油收入实现“代际财富共享”。

- Full investment transparency: company names, amounts, and holdings publicly available. 完全透明:投资公司名称、金额及持股比例全部公开。

- Ethical exclusion guidelines on industries like tobacco, arms, and environmental damage. 设有道德投资准则,排除烟草、武器及破坏环境的企业。

🔗 Official Website 官方网站: https://www.nbim.no/en/

Alaska Permanent Fund Dividend (PFD) 阿拉斯加永久基金红利 (PFD)

- Established in 1976 from oil royalties via constitutional amendment. 于1976年通过宪法修正案设立,资金来自石油特许权收入。

- Annual dividend payout directly to all eligible Alaskan residents. 每年向所有符合条件的阿拉斯加居民发放红利。

- 2023 payout: approximately US$1,312 per person. 2023年每人约获得1312美元。

- Recognized as one of the world’s earliest and most successful universal basic income models. 被认为是全球最早、最成功的“全民基本收入”实践案例之一。

🔗 Official Website 官方网站: https://apfc.org/ | https://pfd.alaska.gov/

📖 Additional Scholarly Resources | 学术资源推荐

- The Alaska Permanent Fund Dividend: A Case Study in Resource Rent Distribution, Karl Widerquist & Michael W. Howard, Palgrave Macmillan, 2012. 《阿拉斯加永久基金红利:资源租金分配案例研究》,卡尔·威德奎斯特、迈克尔·霍华德 著。

- Sovereign Wealth Funds: Legitimacy, Governance, and Global Power, Gordon L. Clark, Adam D. Dixon & Ashby H. B. Monk, Princeton University Press, 2013. 《主权财富基金:合法性、治理与全球力量》,戈登·克拉克、亚当·迪克森、阿什比·蒙克 著。

Your thoughts are welcome. What lessons can Singapore draw from these global examples? 欢迎您的想法与讨论。新加坡可以从这些国际经验中汲取哪些治理灵感?

#Singapore #Governance #Temasek #GIC #SovereignWealth #Transparency #Accountability #SharedProsperity #NationBuilding #FutureOfSingapore

☎️ This article is also published on LinkedIn. For more interesting articles, stories and insights, please visit marvinfoo.com’s blog section.

☎️ 本文亦已发布于 LinkedIn。欲阅读更多精彩文章、故事与深度见解,欢迎访问 marvinfoo.com 的博客专栏。

![#60 [🎓 Reconnecting with Roots: A Special Visit to NUS] 【🎓 重返母校:一场意义非凡的NUS之行】](https://marvinfoo.com/wp-content/uploads/2025/08/IMG20250806122646-768x576.jpg)